Working with roof insurance adjusters means coordinating inspections, documentation, and claim decisions so hail damage is evaluated accurately and paid according to your policy. In Denver, this process comes with real pressure. Hailstorms often affect entire neighborhoods at once, adjuster schedules fill fast, and homeowners feel pushed to move forward before they fully understand the damage.

Most concerns surface early. Homeowners worry the adjuster missed damage, timelines are slipping, or the scope of loss does not reflect what is actually on the roof. Confusion usually peaks when the first insurance check arrives and the amount feels lower than expected. In most cases, that gap comes from depreciation, supplements, or scope limitations, not a denial.

This guide explains how roof insurance adjusters work in Denver, what their role is and what it is not, and how homeowners can protect their claim without slowing it down. You will learn how to prepare for inspections, communicate clearly, and avoid the missteps that cause delays or underpayment. Starting with a clear inspection record, such as using a Denver roof inspection checklist, helps reduce disputes and gives the claim a stronger foundation from day one.

What Denver Homeowners Need to Know Before Meeting an Insurance Adjuster

After a hailstorm, an adjuster visit can feel intimidating. Neighbors are filing claims, timelines feel tight, and there is a sense that this inspection will determine everything. In reality, this step is far more predictable than it feels. When homeowners understand how the process works and prepare correctly, the inspection becomes a structured review instead of a pressure moment.

What Is the Adjuster’s Role During a Roof Inspection?

Yes, the adjuster’s role is to document damage and apply policy terms, not to advocate for or against you. Adjusters identify visible hail impact, confirm storm related damage, and create a scope of loss based on what they can verify and what the policy allows. They are not deciding repair methods, and they are not negotiating coverage during the visit. Their job is evidence, accuracy, and documentation.

What Is the Homeowner’s Role in the Inspection Process?

Yes, the homeowner’s role is to make sure the inspection starts with clear, accurate information. That includes providing the correct storm date, ensuring safe roof access, and having prior documentation ready. Homeowners are not expected to argue pricing or coverage on site. Asking clarifying questions and confirming what areas are being reviewed is appropriate and often helpful.

Does Preparation Matter More Than Persuasion?

Yes, preparation matters far more than persuasion in Denver hail claims. Adjusters work from what they can document, not what they are convinced of verbally. Clear photos, consistent inspection records, and storm specific documentation carry weight long after the visit ends. Homeowners who prepare using a Denver roof inspection checklist reduce the risk of missed damage, re inspections, and delayed approvals.

The most important takeaway is simple. Adjusters document. Homeowners prepare. When those roles are clear, the inspection feels less stressful, outcomes are more consistent, and the claim is less likely to stall later in the process.

What Does a Roof Insurance Adjuster Do in Denver?

This matters because misunderstanding an adjuster’s role is one of the fastest ways Denver homeowners lose time, money, or leverage in a hail claim. Many people assume the adjuster has full decision-making power or is there to “side” with someone. That assumption leads to frustration and misplaced pressure. In reality, an adjuster’s role is defined, limited, and predictable once you understand how insurers operate after Denver hailstorms.

Is the Insurance Adjuster on My Side or the Insurance Company’s?

Yes and no. Adjusters are required to document damage accurately and apply policy terms consistently, but they work for the insurance company and must follow its coverage rules. Their responsibility is to the claim file, not to advocate for either side.

In plain terms, adjusters are neutral fact gatherers, not decision-makers acting on personal judgment. They do not gain by denying legitimate damage, but they also cannot approve repairs that fall outside policy language. Treating the inspection like a negotiation often backfires. Clear documentation and verifiable evidence matter far more than persuasion during the visit.

What Types of Roof Insurance Adjusters Are Used in Denver?

Yes, insurers in Denver regularly use different types of adjusters depending on storm severity and claim volume. Understanding which one you are dealing with explains why the process sometimes feels fast and other times feels distant.

The most common types include:

- Field adjusters, who inspect the roof in person and document damage directly. These are often assigned when damage appears significant or when local staffing allows.

- Desk adjusters, who review photos, inspection reports, and third-party documentation instead of visiting the property. This approach becomes common during peak hail season.

- Third-party inspectors, who gather measurements and photos but do not make coverage decisions. Their reports are reviewed internally before approval.

After large Denver hail events, insurers often rotate between these models to manage volume. None of them signal approval or denial on their own. They simply reflect how the insurer is processing claims at that moment.

The key takeaway is control through understanding. When homeowners know what an adjuster can and cannot do, they respond with the right preparation instead of pressure. That clarity reduces missed damage, shortens follow-ups, and keeps the claim moving on predictable ground.

What to Expect During a Roof Adjuster Inspection in Denver

After a hailstorm, the adjuster inspection is the moment most homeowners worry about. People assume this visit decides everything in one shot. In reality, it is a documentation step, not a verdict. Knowing what actually happens during a Denver roof inspection takes the pressure off and helps you focus on preparation instead of persuasion.

What Will the Adjuster Look for on a Hail-Damaged Roof?

Adjusters document damage patterns, test shingles, and measure affected areas.

During a hail inspection, the adjuster’s job is to confirm whether storm damage exists and how widespread it is. They look for consistent hail impact marks, check shingles for brittleness or fractures, and document collateral damage such as dented vents, flashing, gutters, or soft metals. The roof is then broken into slopes and facets so damaged areas can be measured accurately.

This is not about proving intent or fault. It is about creating a defensible record of what the storm did and where it did it.

Should I Be Present During the Adjuster Inspection?

Yes, being present is usually beneficial but not mandatory.

Being there allows you to ask clarifying questions and ensure all roof areas are accessed, especially on complex or steep homes. It can also help align what the adjuster sees with any prior professional inspection findings. That said, presence alone does not influence approval. Adjusters rely on documentation, not conversations.

If you cannot attend, the inspection can still proceed without harming the claim, as long as roof access is clear and safe.

How Long Does a Roof Adjuster Inspection Usually Take?

Most inspections take 30 to 90 minutes, depending on roof size and access.

Smaller, straightforward roofs move quickly. Larger homes, steep pitches, multiple rooflines, or limited access naturally extend inspection time. Delays are also common after major Front Range hail events when adjusters are handling high claim volumes.

A longer inspection does not signal trouble. It usually means the adjuster is documenting thoroughly, which helps reduce disputes later.

Bottom line: a roof adjuster inspection in Denver is a structured assessment, not a negotiation. When homeowners understand that, the process feels far more predictable and far less intimidating.

How to Prepare Before the Adjuster Shows Up

The adjuster visit is where most roof claims quietly go right or quietly go sideways. Not because of bad intent, but because decisions get made quickly and first impressions matter. Preparation here is not about arguing or pushing. It’s about making sure the damage is seen clearly, tied to the right storm, and documented once instead of revisited later. In Denver, where multiple hailstorms can hit the same neighborhood in a single season, that preparation often determines whether a claim moves forward smoothly or drags on with re inspections and supplements.

Should I Get a Professional Roof Inspection Before the Adjuster Visit?

Yes. Getting a professional roof inspection before the adjuster arrives helps document damage accurately and reduces missed items.

A contractor inspection creates an independent record of what was damaged, when it likely occurred, and how widespread it is. This matters in Denver because insurers often compare storm dates, hail sizes, and claim volumes across overlapping events. When damage is not clearly tied to a specific storm, claims slow down or get partially approved.

An inspection does not replace the adjuster’s job. It simply ensures that when the adjuster is on the roof, both sides are looking at the same problem instead of discovering issues weeks later. Homeowners who skip this step often face follow up inspections, revised scopes, or delayed supplements that could have been avoided upfront. A simple pre inspection, guided by a clear roof inspection checklist, removes much of that uncertainty early.

What Documents and Photos Should I Have Ready?

Yes, having documentation ready before the inspection helps the claim move faster and with fewer questions.

Start with clear photo evidence taken as soon as it was safe after the storm. That includes wide shots of each roof slope, close ups of visible hail impacts, and any collateral damage like dented vents, gutters, or siding. Photos help establish storm timing and condition before any changes occur.

You should also have basic storm information available, such as the approximate date and any weather alerts you received. In Denver, where storms can happen days apart, this helps prevent confusion about which event caused the damage. If the roof has had prior repairs or partial replacements, having those records ready avoids misinterpretation during the scope review.

When this information is missing, adjusters often have to pause, request follow ups, or schedule another visit. That is how simple claims turn into drawn out ones. Having everything ready does not guarantee approval, but it removes preventable friction from the process.

What to Say (and Not Say) to a Roof Insurance Adjuster

This is the part of the process that makes homeowners tense. Not because they plan to say anything wrong, but because no one wants an offhand comment to quietly derail a valid claim. The good news is this. You do not need special language or negotiation skills. What matters is understanding how casual remarks can be interpreted once they are written into a claim file. In Denver, where hail claims are common and documentation gets reviewed closely, clarity beats commentary every time.

Can What I Say to an Adjuster Affect My Claim?

Yes. Statements you make can influence how damage is interpreted, even when that is not your intent.

Adjusters document observations and homeowner statements as part of the claim record. A comment meant to be polite or conversational can be logged as context about roof condition, maintenance history, or damage timing. For example, saying you are not sure when the damage happened or that the roof is pretty old can unintentionally shift how the loss is evaluated.

This does not mean you should be guarded or evasive. It means your role is to describe what you observed, not to speculate or diagnose. Stick to facts you are confident about. When you do not know an answer, it is better to say that clearly than to guess. Adjusters are trained to assess damage. Homeowners help most by providing accurate, limited information rather than interpretations.

Common Phrases That Create Problems Without Realizing It

Many claim issues start with well meaning comments that feel harmless in the moment. The risk is not dishonesty. It is ambiguity.

Saying things like you noticed the damage months ago or that the roof has probably needed replacing for a while can blur the timeline, especially in Denver where multiple hailstorms may occur in a single season. Mentioning past leaks or general wear without context can also invite questions about pre existing conditions.

A better approach is to frame what you know with certainty. For example, you can say you noticed new dents, missing granules, or leaks after a specific storm. You can point out areas that look different than before. These are observations, not conclusions. They give the adjuster usable information without introducing uncertainty.

The goal is not to be silent or scripted. It is to keep the conversation factual and focused. When homeowners do that, claims tend to stay cleaner, reviews move faster, and fewer clarifications are needed later.

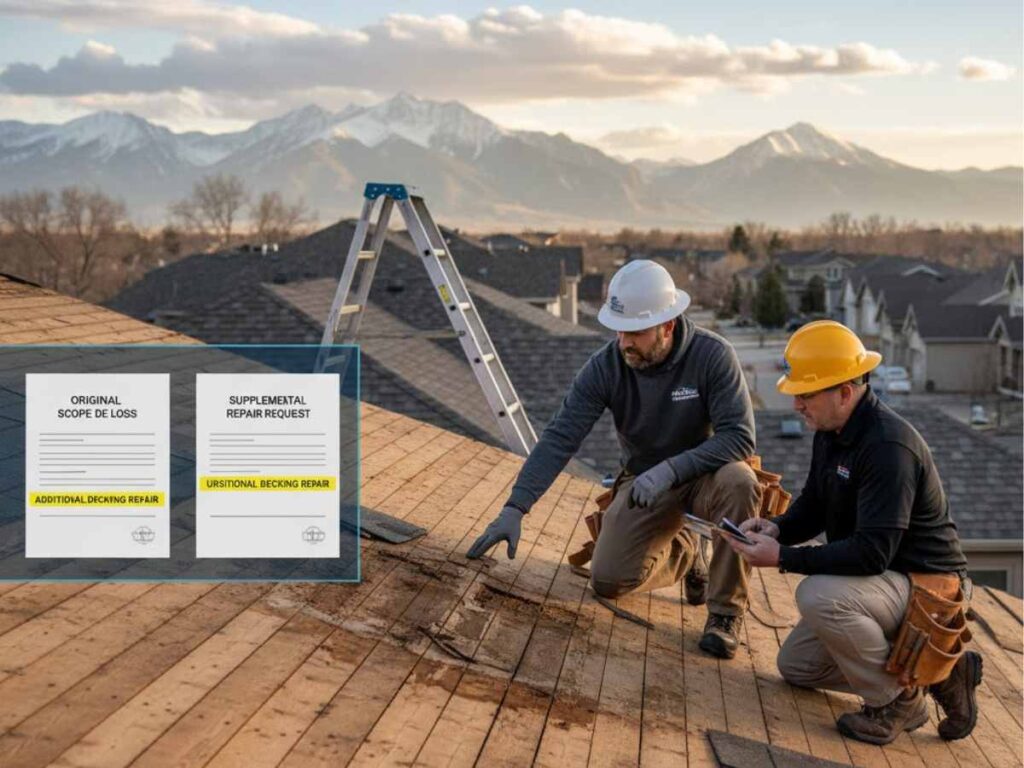

Understanding the Scope of Loss the Adjuster Provides

This is the moment where many Denver homeowners feel unsure. The inspection is done, the paperwork arrives, and suddenly there’s a multi-page document full of line items and dollar amounts. It feels official. Final, even. But here’s the thing: the scope of loss is not a verdict. It’s a starting point.

What Is a Scope of Loss and Why Does It Matter?

Yes, the scope of loss defines what the insurance company currently agrees to pay for. It lists the areas of damage the adjuster observed, the repairs approved so far, and how costs were calculated under your policy.

In plain English, this document sets the financial boundaries of your claim at that moment in time. Contractors use it to plan roof repairs after a hailstorm, while insurers use it to justify payments.. If something is missing here, it usually does not get paid unless it is corrected later.

In Denver hail claims, scopes are often written conservatively. Adjusters document visible damage first, not every issue that may appear once work begins. That is normal, especially when hailstorms affect entire neighborhoods at once.

What If the Scope of Loss Seems Too Low?

Yes, low scopes are common and are often corrected through supplements. A lower-than-expected scope does not automatically mean the claim is being denied or undervalued.

Initial scopes are based on what can be confirmed during a surface inspection. Once repairs start, additional damage is frequently uncovered. Examples include damaged underlayment, compromised flashing, or decking issues that were not visible during the first visit. These items are addressed through a supplemental claim, which updates the scope to reflect real repair conditions.

The key point is this: the scope of loss is a snapshot, not a blueprint. Reviewing it carefully and understanding what it includes and excludes matters far more than reacting emotionally to the first number on the page.

ACV vs RCV Explained in Plain English

This is the point in a Denver hail claim where frustration usually spikes. The adjuster leaves, paperwork arrives, and the first insurance check looks far smaller than expected. Most of the time, nothing is wrong. The confusion comes from how depreciation works under ACV versus RCV coverage.

What Is the Difference Between ACV and RCV Coverage?

| Coverage Type | What It Means in Practice | How the First Check Works | What Happens Next | Why It Matters in Denver |

|---|---|---|---|---|

| Actual Cash Value (ACV) | Pays for the roof based on its age and condition at the time of damage | Depreciation is deducted upfront | No additional reimbursement later | Older roofs take a bigger hit after hail |

| Replacement Cost Value (RCV) | Pays the full cost to replace the roof, minus depreciation at first | Initial check is lower because depreciation is held back | Depreciation is paid after repairs are completed | Most Denver hail claims follow this structure |

| Depreciation | The value insurers assign to roof wear over time | Reduces the first payment only | Released after proof of repairs | Confuses homeowners when the first check arrives |

| Final Payout | ACV is final once paid | RCV requires a second step | Requires invoices and completion proof | Explains why claims stay open longer |

| Timeline Impact | Often closes faster | Takes longer due to depreciation recovery | Adds weeks after repairs | Normal for Front Range hail claims |

Yes, ACV deducts depreciation upfront, while RCV reimburses that depreciation later. That is the simplest and most accurate way to think about it.

Actual Cash Value coverage pays what your roof is worth today, factoring in age and wear. If a Denver hailstorm damages a 15-year-old roof, the insurer subtracts depreciation before issuing payment. You never get that depreciation back under an ACV policy.

Replacement Cost Value coverage works differently. With RCV, the insurer first pays the depreciated amount, then releases the withheld depreciation after repairs are completed and documented. Most Denver homeowners carry RCV policies, but many do not realize that depreciation is paid in stages, not all at once.

How Depreciation Affects Your Final Roof Payout

Yes, depreciation delays part of your payment, but it does not reduce it under RCV coverage.

Depreciation represents the age and condition of the roof at the time of loss. In an RCV claim, the insurer holds back that amount until repairs are completed and documented.

Here is what that looks like in a real Denver hail scenario. The adjuster approves a roof replacement for $20,000. If depreciation is $7,000 and your deductible is $2,500, the first check will be much lower than expected. That initial payment often triggers panic, but it is only the first phase.

Once the roof is replaced and the work is verified, the insurer releases the withheld depreciation. That second payment is what brings the total reimbursement closer to the full replacement cost.

This is why timing matters. ACV claims close faster but usually cost homeowners more out of pocket. RCV claims take longer, but they are designed to make the homeowner whole after repairs are finished.

Understanding this distinction early helps Denver homeowners avoid two common mistakes. Assuming the first check is the final one, or approving repairs without understanding how depreciation recovery works.

A Simple Mental Model for Depreciation Release

Think of depreciation as money the insurer sets aside, not money they take away. On an RCV policy, the insurer pays part of the claim first, then releases the rest once the roof is replaced. The claim stays open because the process is incomplete, not because something is wrong.

If the roof is never repaired, depreciation is never paid. That is the tradeoff built into RCV coverage.

Denver Hail Claim Example With Real Numbers

A hailstorm damages a roof in Highlands Ranch.

- Approved replacement cost: $18,000

- Roof age: 12 years

- Depreciation: $6,000

- Deductible: $2,500

First insurance payment

- $18,000 replacement cost

- minus $6,000 depreciation

- minus $2,500 deductible

- Initial payment: $9,500

This is where most confusion starts. Homeowners assume the claim is underpaid, even though it is moving exactly as designed.

After the roof is replaced

- Contractor invoice submitted

- Proof of completion provided

- Depreciation released: $6,000

Total insurance payout

- $15,500

- Homeowner pays the deductible only

Nothing unusual happened. No money was lost. The timeline simply followed the RCV structure that most Denver hail claims use.

Why This Matters for Denver Homeowners

Yes, understanding depreciation early prevents panic, delays, and bad decisions.

Colorado hail damage is often subtle at first. Shingles bruise, granules loosen, and fractures show up only after inspection. That makes depreciation, supplements, and second payments normal in Denver, not exceptional.

Homeowners who understand ACV versus RCV are far less likely to:

- Panic after the first check

- Assume the claim was denied or underpaid

- Rush into repairs without understanding depreciation recovery

This knowledge turns a confusing process into a predictable one, which is exactly what homeowners need during a hail claim.

When and Why Roof Insurance Supplements Are Normal in Denver

For many Denver homeowners, the word supplement sounds like a problem. It often shows up after the first insurance check arrives, when everyone expected the claim to be finished. In reality, supplements are a routine part of hail claims in Colorado and usually signal that the process is working as designed, not breaking down.

The key is understanding why supplements exist and what they actually change in the timeline.

Why Does My Roof Claim Need a Supplement?

Yes, supplements are usually needed because hidden or code-related damage appears after work begins.

Hail damage in Denver is rarely obvious from the street. Shingles bruise, granules loosen, and fractures hide beneath surface layers. Adjusters can only document what is visible during the initial inspection. Once tear-off starts, additional issues often come into view.

Common supplement triggers include concealed decking damage, underlayment failure, ventilation components, or code-required upgrades that were not identifiable during the first inspection. These findings do not mean the adjuster missed something or that the claim was mishandled. They reflect the reality that roofs are layered systems, not flat surfaces.

In Denver’s hail environment, supplements are normal because inspections happen before full exposure is possible.

How Long Do Supplements Add to the Claim Timeline?

Yes, supplements usually add time, but the delay is typically measured in weeks, not months.

In most Denver hail claims, a supplement adds one to three weeks once documentation is submitted. That timeline depends on how quickly the additional scope is reviewed and approved, as well as overall claim volume after major storms.

During peak hail season, review times can stretch longer as insurers process large numbers of supplemental requests at once. Outside of those surges, approvals tend to move faster, especially when documentation is clear and aligns with local repair standards.

The important thing to understand is this: a supplement does not reset the claim. It extends a specific phase of it. When handled correctly, it leads to a more accurate payout rather than a stalled or disputed claim.

For Denver homeowners, supplements are less about delay and more about completeness. They exist to ensure the final settlement reflects the actual work required, not just what was visible on inspection day.

Common Disputes Between Homeowners and Adjusters (and How to Handle Them)

Disagreements during a roof claim usually aren’t personal, and they’re rarely about honesty. Most disputes come down to how damage is classified, measured, or documented. In Denver hail claims, these friction points are predictable. Knowing how they show up makes them easier to resolve without turning the process into a standoff.

Cosmetic vs Functional Damage Disputes

Yes, disputes often arise when damage is labeled cosmetic instead of functional.

Adjusters may classify certain hail impacts as cosmetic if shingles are bruised but not visibly broken or leaking. Homeowners hear “cosmetic” and assume the damage is being dismissed. What’s really happening is a coverage interpretation based on policy language and observable performance at inspection time.

The calm way forward is documentation, not argument. Functional impact is established through patterns, test results, and manufacturer tolerances, not opinions. When additional evidence shows that bruising affects shingle lifespan or water shedding ability, classifications often change through review or supplementation. This is procedural, not confrontational.

Missed Collateral Damage Like Gutters or Vents

Yes, collateral items are commonly missed during initial inspections.

Gutters, downspouts, roof vents, flashing, and soft metal components are easy to overlook during a fast inspection, especially after large Denver hailstorms. These items are often reviewed separately or added later once closer inspection occurs.

When collateral damage is identified after the adjuster visit, it’s usually resolved by submitting clear photos and measurements tied to the same storm event. This is a normal correction step, not a dispute escalation. Most insurers expect collateral items to be addressed as the claim matures.

Measurement Errors and Roof Complexity Issues

Yes, roof measurements and complexity are frequent sources of disagreement.

Steep slopes, multiple facets, dormers, and complex layouts can lead to measurement differences between initial estimates and actual requirements. In Denver neighborhoods with varied roof designs, this happens often.

These disputes are resolved through verification, not pressure. Updated measurements, diagrams, and access notes usually correct the scope without conflict. When complexity is clearly documented, revised calculations are commonly approved through the standard review process.

Across all three dispute types, the pattern is the same. Clear documentation, calm follow-up, and patience move claims forward faster than escalation. Most Denver roof claim disagreements aren’t roadblocks. They’re checkpoints in a process designed to refine accuracy over time.

Do I Need a Public Adjuster for a Denver Roof Claim?

This question usually comes up when a claim feels slow, confusing, or underfunded. Public adjusters are often discussed as a solution, but they are not a universal fix. In Denver roof claims, whether one makes sense depends on claim complexity, communication breakdowns, and how far the process has already progressed.

When a Public Adjuster May Make Sense

Yes, a public adjuster can be useful in specific situations.

Public adjusters work for the homeowner, not the insurance company. They review the claim, document damage, and negotiate the scope and valuation on the homeowner’s behalf. In Denver, they are most often helpful when a claim involves repeated denials, unresolved scope disputes, or prolonged delays without clear explanations.

They may also make sense for large, complex losses where multiple structures, code upgrades, or layered damage are involved. In those cases, the added coordination and negotiation can help move a stalled claim toward resolution. This is less about speed and more about clarity and leverage when normal communication has broken down.

When a Public Adjuster Usually Is Not Necessary

No, most Denver roof claims do not require a public adjuster.

Straightforward hail claims with clear damage, standard policies, and active communication typically resolve through the normal adjustment process. In these cases, adding a public adjuster can increase cost without improving outcomes, since they are paid a percentage of the settlement.

Public adjusters are also less useful early in the process, before inspections, scopes, and documentation are complete. At that stage, most delays are procedural rather than adversarial. Many Denver homeowners see claims move forward once inspections are aligned, documentation is clarified, or supplements are properly submitted.

The key takeaway is fit. Public adjusters are a tool, not a default step. They tend to add value when a claim is genuinely stuck, not when it is simply moving at a normal pace for Denver’s hail-driven environment.

Colorado-Specific Rules That Affect Adjuster Behavior and Timelines

Roof insurance claims in Denver do not operate in a vacuum. They are shaped by Colorado insurance law and by the realities of frequent hail events along the Front Range. Understanding these rules helps homeowners separate normal procedural delays from situations that deserve closer attention.

What Does Colorado Law Require Insurance Adjusters to Do?

Yes, Colorado law requires insurance adjusters to investigate, communicate, and process claims in good faith and without unreasonable delay.

Adjusters are legally obligated to acknowledge a claim, conduct a reasonable investigation, and keep the homeowner informed as the claim moves forward. They must base decisions on policy language and documented damage, not convenience or volume pressure.

What Colorado law does not do is set a fixed number of days for inspections, approvals, or payments. Instead, the standard is reasonableness. That means timelines are evaluated based on claim complexity, storm volume, and how quickly required information is provided.

For homeowners, the practical takeaway is simple. Waiting during busy hail seasons can be normal. Silence without explanation is not. When communication stops or decisions stall without clear reasoning, that is when a delay becomes a concern under Colorado standards.

Why Do Hail Claims in Denver Often Take Longer Than in Other States?

Yes, hail-related roof claims in Denver often take longer because of claim volume and inspection capacity, not because of homeowner error.

Along the Front Range, hail damage roof insurance claims in Denver often surge at the same time as entire neighborhoods are impacted by a single storm.. When that happens, insurers receive a surge of claims in a very short time. Adjusters are reassigned, inspection queues grow, and review teams handle overlapping storm events.

This affects behavior on the ground. Inspections may be scheduled further out. Desk adjusters or third-party inspectors may be used more often. Internal reviews can take longer simply because more claims are moving through the system at the same time.

The key point is predictability. Denver hail claims tend to slow at the same stages for the same reasons. These delays are usually structural, not personal, and they resolve as claim volume normalizes. Knowing this helps homeowners stay calm while still recognizing when a claim truly stops progressing.

Common Questions Denver Homeowners Ask About Working With Adjusters

Once the adjuster visit is over, new questions usually pop up. Homeowners start comparing notes with neighbors, watching timelines stretch, and wondering whether what they’re seeing is normal or a sign of trouble. This section answers the questions that come up most often in Denver, using plain English and real-world context.

Can a Roof Claim Be Approved Without an Adjuster Inspection?

No, a roof insurance claim is rarely approved without some form of inspection.

Insurance companies need documented evidence of damage before approving coverage. In most cases, that means an in-person inspection by a field adjuster. In higher-volume hail events, insurers may use virtual inspections, desk adjusters, or third-party inspectors instead of sending someone on site.

Even then, an inspection still happens. It just happens through photos, reports, or uploaded documentation rather than a ladder on your roof. Claims approved with no inspection at all are uncommon and typically limited to very small or previously documented losses.

Why Did My Neighbor’s Adjuster Approve More Damage Than Mine?

Yes, it’s possible for two similar roofs on the same street to receive different approvals.

This usually comes down to documentation, inspection method, and timing. One neighbor may have had a field adjuster who physically tested shingles, while another had a desk adjuster reviewing photos. One inspection may have captured collateral damage like vents or flashing, while another focused only on shingle impacts.

Policy details matter too. Differences in coverage type, deductible structure, or cosmetic damage exclusions can all affect what gets approved. A higher approval does not automatically mean your claim was handled incorrectly, but it does mean the scopes are worth comparing carefully.

What Should I Do If I Disagree With the Adjuster’s Findings?

Yes, disagreements are common, and they are usually handled through documentation rather than confrontation.

If the scope of loss seems incomplete or inaccurate, the next step is to review it line by line and identify what appears to be missing or undervalued. Most corrections happen through supplements supported by photos, measurements, or repair standards.

What helps is staying specific. Focus on what is missing and why it matters, not on intent or blame. Claims move forward faster when disagreements are framed as documentation gaps instead of arguments.

How Long Does an Adjuster Have to Respond in Colorado?

Yes and no. Colorado requires timely communication, but it does not set a fixed response deadline for every adjuster action.

Adjusters are expected to acknowledge claims, respond to inquiries, and keep the process moving without unreasonable delay. What counts as reasonable depends on storm volume, claim complexity, and whether required information has been provided.

In practice, a few days between updates can be normal during busy hail seasons. Long gaps with no response or explanation are not. When communication stops entirely, that is usually the signal to request a clear status update in writing.

Key Takeaways for Working With Roof Insurance Adjusters in Denver

Before wrapping up, these are the core truths Denver homeowners should walk away with after meeting an insurance adjuster.

- Preparation matters more than pressure.

Claims move forward when inspections, photos, and documentation clearly support the damage. Trying to rush or persuade an adjuster rarely changes outcomes. - Adjusters follow policy rules, not opinions.

Every decision is tied to coverage language, inspection findings, and carrier guidelines, not personal judgment or negotiation tactics. - Most delays are procedural, not personal.

Hail volume, adjuster backlogs, internal reviews, supplements, and depreciation release commonly extend timelines in Denver without signaling a problem. - The scope of loss is a checkpoint, not a final answer.

Initial scopes are often incomplete and corrected later once repairs reveal hidden or code-related damage. - Disagreements are solved with documentation, not confrontation.

Claims resolve faster when gaps are addressed calmly with photos, measurements, and repair standards rather than emotional pushback. - Understanding the process reduces stress and mistakes.

Homeowners who know what to expect make better decisions and avoid common errors that slow claims down.

How to Work With Adjusters Without Hurting Your Claim

Working with roof insurance adjusters in Denver is less about saying the right things and more about understanding how the process actually works. Adjusters follow policy language, documentation standards, and inspection findings, especially after hailstorms that impact entire neighborhoods at once.

Most claims don’t stall because of mistakes. They slow down when inspections are incomplete, scopes aren’t fully understood, or homeowners assume the first payment is final. When preparation, documentation, and follow-up stay clear, the process tends to move in predictable stages.

Denver hail claims are rarely fast, but they are rarely random. Knowing how inspections, depreciation, supplements, and reviews fit together helps homeowners make calm, informed decisions instead of rushed ones. That clarity is why many homeowners rely on local Denver roofing contractor with hands-on experience navigating hail claims, inspections, and repair requirements every day. The goal isn’t to control the adjuster. It’s to understand the system well enough that it works the way it’s designed to.

Recent Comments